Thursday, January 16, 2014

Sunday, January 12, 2014

Here's a skill for getting students to learn how to influence others: Videos are meant to be heard

http://www.youtube.com/watch?v=_KhEZjzlqIA Let's say taht you like this song. How do you get the mp3 audio track onto an mp3 file?

Step one: get the Youtube link

Step 2: go to vid2mp3.net

Here are the steps

If you see a video that you respect, be nice to your friends.

a) convert it to mp3

b) share it

http://www.vidtomp3.com/

Step one: get the Youtube link

Step 2: go to vid2mp3.net

Here are the steps

If you see a video that you respect, be nice to your friends.

a) convert it to mp3

b) share it

http://www.vidtomp3.com/

If you find this book of Jose Martí's poems, please buy three copies....

How many times have you seen this stunning and sad entry on Amazon.com?

Yes, no available books.

Visit this page and experience it.

http://www.amazon.com/Come-Come-My-Boiling-Blood-Complete/dp/1931896399/

|

| How about this |

Yes, no available books.

Visit this page and experience it.

|

| Click here to experience this sad listing... |

http://www.amazon.com/Come-Come-My-Boiling-Blood-Complete/dp/1931896399/

Labels:

collection,

jose marti,

poems,

review

Friday, January 3, 2014

Joe's blog has a question: Do we REALLY need to put objectives on the board? Do you see objectives when you read a newspaper?

Let's celebrate the diversity of voices in education. Here's a post by Alfie Kahn

I heard about this post from a blogger named Joe

I like his post. Why not click and subscribe to Joe's blog?

Labels:

objectives,

suggestions,

teacher talk,

teacher writing

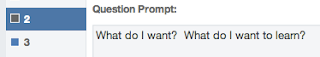

Let's start the conversation with students by listening to their answers to these six questions

|

| Click here |

Let's use the words of Neil Postman from Teaching as a Subversive Activity and listen to our students.

(thank you, Oregon State, for posting the pdf)

See chapter 12: 3. Try listening to your students for a day or two. We do not mean reacting

to what they say. We mean listening.

DOWNLOAD the poster

Thanks to Dennis Yuzenas for recommending this book.

Labels:

dennis yuzenas,

effective teaching,

neil postman,

subversive

"Teachers don't earn enough...." Oh? let's see....

I've often wondered about the assumption that "teachers are not paid enough for the work they do."

We get to work with people who have college degrees

We get to work with people who have inquiring minds (often)

We get to work with people who

We get the psychic income (delayed by ten or twenty years) from having our clients tell us, "You changed my life." Wow.

We are usually in air-conditioned spaces.

We don't have to haul garbage.

We usually don't have to sweep or clean windows or lift heavy objects.

And in Florida, the typical teacher earns more than the median income. So... where is the inequity?

Source of the graphic

|

| Source OF the graphic: http://www.paul-bruno.com/wp-content/uploads/2013/12/teachersalariessorted.png |

We get to work with people who have inquiring minds (often)

We get to work with people who

We get the psychic income (delayed by ten or twenty years) from having our clients tell us, "You changed my life." Wow.

We are usually in air-conditioned spaces.

We don't have to haul garbage.

We usually don't have to sweep or clean windows or lift heavy objects.

And in Florida, the typical teacher earns more than the median income. So... where is the inequity?

Source of the graphic

What did Einstein say about fish and climbing trees? What was his real opinion about education?

|

| Here is a poster to support Professor Pettigrew's suggestion FREE DOWNLOAD |

Oh, no...not again... another excellent and timely quote is exposed as a fabrication... Oh, I really wanted to believe that Einstein thought about fish and tree climbing....

We will do well to take time to look at the "investigation" about the source of the "Einstein quote."

Click here to see the investigation

|

| Click here to see the article in Macleans |

|

| Professor Pettigrew recommends the Quote Investigator |

=======

So let's create an excellent poster about Einstein to offset the fish-climbing-trees quote.

Get the poster

Here is an excerpt from the Investigation

|

| Click here to give them the HIT and click LIKE and recommend the page on Twitter and Facebook |

By the way, why not give some thanks to Todd Pettigrew by clicking on some of his other pieces in Macleans?

Search Results

Don't blame me for appalling Saint Mary's chant – - Maclean's On ...

Don't blame me for appalling Saint Mary's chant. By Todd Pettigrew | September 6th, 2013 | 12:04 pm. Filed Under: Blog Central • Campus News • The Hour ...

Labels:

climb trees,

curiosity,

Einstein,

fish,

imagination

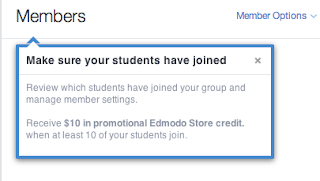

Edmodo lets teachers create free quizzes

Here's my experience with Edmodo. I've taken some screenshots and I've created a quiz with SHORT ANSWERS and six questions. Here is the link

I hope you will visit the quiz. https://www.edmodo.com/home#/group?id=6935797

The founder of Lawrence Academy Charter School, Dr. Burnett, recommended Edmodo to me. I'm impressed with the soft nature of the social medium.

You can visit my account.

My account: https://www.edmodo.com/home#/profile/30708399 I hope I can create a "custom name" so it is easier to find...

Some links to help teachers:

For more information, visit my Edmodo account

My account: https://www.edmodo.com/home#/profile/30708399

I hope you will visit the quiz. https://www.edmodo.com/home#/group?id=6935797

The founder of Lawrence Academy Charter School, Dr. Burnett, recommended Edmodo to me. I'm impressed with the soft nature of the social medium.

You can visit my account.

My account: https://www.edmodo.com/home#/profile/30708399 I hope I can create a "custom name" so it is easier to find...

Some links to help teachers:

Edmodo

I'm a Teacher: Account Settings & Notifications» ... Have Students Join Your Group (not yet an Edmodo Student) (Teacher) · Understand Your Group Code (Teacher) ...Claim Your Own Edmodo Profile URL (Teacher) · Edit Your Privacy ..... to my own ... (1) » · Why does "Me" show up next to my own posts and not my name? A Guide to Getting Started With Edmodo - The Edmodo Blog

Jun 28, 2013 - If you just created an account, a great way to get started is to attend one .... I need help to set up some activities for my lower elementary music ...- [PDF]

Edmodo User Guide - Giles County Schools

Before a student can create an Edmodo account, they will need a 6-‐digit group code from ... create a unique username and password, and provide their name. .....You can create your own set of personalized tags to help organize and sort all your posts. .... Select “view my public profile” to see how your profile looks to other ... 7 Steps on How to Use the New Edmodo - Teq Blog

Jul 18, 2013 - Creating an Edmodo Account: Teacher and Student. The first... One of my favorite features of Edmodo is probably one of the most underutilized and ... You can then save these resources to your own Edmodo Library with one click. ... Next to the name of the group you'll see a little cog representing “settings”.

Here is my account

My account: https://www.edmodo.com/home#/profile/30708399 I hope I can create a "custom name" so it is easier to find...

For more information, visit my Edmodo account

My account: https://www.edmodo.com/home#/profile/30708399

Labels:

edmodo,

make quizzes,

social media

Thursday, January 2, 2014

A list of topics for teaching about Finances for Teenagers: Let's get started

Here are some topics that come from an interesting website.

To students: Your task, students, is to choose the topics that you want to learn about. Bring your questions to the next class.

===================

Some powerpoints for teenagers to use

To students: Your task, students, is to choose the topics that you want to learn about. Bring your questions to the next class.

===================

Some powerpoints for teenagers to use

Tool: What information should young people know about Finances?

The Ten Basic Money Skills

In her book, Raising Financially Fit Kids, Joline Godfrey gives a list of lessons called “The Ten Basic Money Skills”:11

1. How to save

2. How to keep track of money

3. How to get paid what you are worth

4. How to spend money wisely

5. How to talk about money

6. How to live on a budget

7. How to invest

8. How to exercise the entrepreneurial spirit

9. How to handle credit

10. How to use money to change the world

Twelve Months of Financial Literacy

Dr. Lewis Mandell outlines the 12 most important concepts for young people to learn, presented as a once a month concept.

- Pay yourself first (understanding why, how and where to save)

- What you make is not what you take (gross pay vs. net pay)

- Start saving young, but it’s never too late to begin (the power of compounding)

- Compare interest rates (shop for both savings and investment as well as credit)

- Don’t borrow what you can’t pay for

- Budget

- Money doubles by the “Rule of 72”

- High returns = High risk

- If it seems too good to be true, it probably is

- Plot a financial road map

- Your credit past is your credit future

- Stay insured

“National Standards in K-12 Personal Finance Education”

The Jump$tart Coalition for Personal Financial Education, an association of organizations interested in advancing financial literacy among youth, has developed the following standards for youth financial literacy education. Note: These standards are called “national” but are not endorsed by any Federal agency but do nonetheless provide an outline of core financial education topics to cover.

A. Financial Responsibility and Decision Making

Overall Competency: Apply reliable information and systematic decision making to personal financial decisions.

Standard 1: Take responsibility for personal financial decisions.

Standard 2: Find and evaluate financial information from a variety of sources.

Standard 3: Summarize major consumer protection laws.

Standard 4: Make financial decisions by systematically considering alternatives and consequences.

Standard 5: Develop communication strategies for discussing financial issues.

Standard 6: Control personal information.

B. Income and Careers

Overall Competency: Use a career plan to develop personal income potential.

Standard 1: Explore career options.

Standard 2: Identify sources of personal income.

Standard 3: Describe factors affecting take-home pay.

C. Planning and Money Management

Overall Competency: Organize personal finances and use a budget to manage cash flow.

Standard 1: Develop a plan for spending and saving.

Standard 2: Develop a system for keeping and using financial records.

Standard 3: Describe how to use different payment methods.

Standard 4: Apply consumer skills to purchase decisions.

Standard 5: Consider charitable giving.

Standard 6: Develop a personal financial plan.

Standard 7: Examine the purpose and importance of a will.

D. Credit and Debt

Overall Competency: Maintain creditworthiness, borrow at favorable terms, and manage debt.

Standard 1: Identify the costs and benefits of various types of credit.

Standard 2: Explain the purpose of a credit record and identify borrowers' credit report rights.

Standard 3: Describe ways to avoid or correct debt problems.

Standard 4: Summarize major consumer credit laws.

E. Risk Management and Insurance

Overall Competency: Use appropriate and cost-effective risk management strategies.

Standard 1: Identify common types of risks and basic risk management methods.

Standard 2: Explain the purpose and importance of property and liability insurance protection.

Standard 3: Explain the purpose and importance of health, disability, and life insurance protection.

F. Saving and Investing

Overall Competency: Implement a diversified investment strategy that is compatible with personal goals.

Standard 1: Discuss how saving contributes to financial well-being.

Standard 2: Explain how investing builds wealth and helps meet financial goals.

Standard 3: Evaluate investment alternatives.

Standard 4: Describe how to buy and sell investments.

Standard 5: Explain how taxes affect the rate of return on investments.

Standard 6: Investigate how agencies that regulate financial markets protect investors.

A. Financial Responsibility and Decision Making

Overall Competency: Apply reliable information and systematic decision making to personal financial decisions.

Standard 1: Take responsibility for personal financial decisions.

Standard 2: Find and evaluate financial information from a variety of sources.

Standard 3: Summarize major consumer protection laws.

Standard 4: Make financial decisions by systematically considering alternatives and consequences.

Standard 5: Develop communication strategies for discussing financial issues.

Standard 6: Control personal information.

B. Income and Careers

Overall Competency: Use a career plan to develop personal income potential.

Standard 1: Explore career options.

Standard 2: Identify sources of personal income.

Standard 3: Describe factors affecting take-home pay.

C. Planning and Money Management

Overall Competency: Organize personal finances and use a budget to manage cash flow.

Standard 1: Develop a plan for spending and saving.

Standard 2: Develop a system for keeping and using financial records.

Standard 3: Describe how to use different payment methods.

Standard 4: Apply consumer skills to purchase decisions.

Standard 5: Consider charitable giving.

Standard 6: Develop a personal financial plan.

Standard 7: Examine the purpose and importance of a will.

D. Credit and Debt

Overall Competency: Maintain creditworthiness, borrow at favorable terms, and manage debt.

Standard 1: Identify the costs and benefits of various types of credit.

Standard 2: Explain the purpose of a credit record and identify borrowers' credit report rights.

Standard 3: Describe ways to avoid or correct debt problems.

Standard 4: Summarize major consumer credit laws.

E. Risk Management and Insurance

Overall Competency: Use appropriate and cost-effective risk management strategies.

Standard 1: Identify common types of risks and basic risk management methods.

Standard 2: Explain the purpose and importance of property and liability insurance protection.

Standard 3: Explain the purpose and importance of health, disability, and life insurance protection.

F. Saving and Investing

Overall Competency: Implement a diversified investment strategy that is compatible with personal goals.

Standard 1: Discuss how saving contributes to financial well-being.

Standard 2: Explain how investing builds wealth and helps meet financial goals.

Standard 3: Evaluate investment alternatives.

Standard 4: Describe how to buy and sell investments.

Standard 5: Explain how taxes affect the rate of return on investments.

Standard 6: Investigate how agencies that regulate financial markets protect investors.

Passport to Financial Literacy (from the State of Oklahoma)

High school students in Oklahoma are required to study Financial topics. Additional information is available at sde.state.ok.us/Curriculum/PFLP/. These state standards are provided as an example; other states may have similar areas for instruction for high school students.

The Passport to Financial Literacy shall include, but is not limited to, the following 14 Areas of Instruction:

- Understanding interest, credit card debt, and online commerce;

- Rights and responsibilities of renting or buying a home;

- Savings and investing;

- Planning for retirement;

- Bankruptcy;

- Banking and financial services;

- Balancing a checkbook;

- Understanding loans and borrowing money, including predatory lending and payday loans;

- Understanding insurance;

- Identity fraud and theft;

- Charitable giving;

- Understanding the financial impact and consequences of gambling;

- Earning an income; and

- Understanding state and federal taxes.

This list of topics comes from this website:

This material is copyrighted by the idaresources at ACF.HHS.Gov

This list of topics is available for teenagers to bring to class.

Labels:

financial literacy,

money,

skills

Subscribe to:

Posts (Atom)